can you go to prison for not filing taxes

The short answer is maybe it depends on why youre not paying your taxes. Failure to File a Return.

Non Filing Of Income Tax Returns Despite Earning Taxable Salary

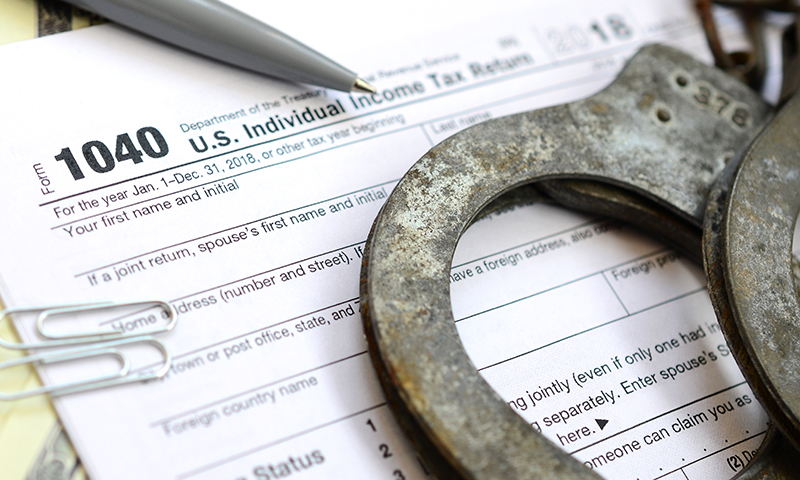

Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years.

. A tax debt of 10000 will then incur a monthly interest of 500. Whatever the reason once you havent filed for several years it can be tempting to continue letting it go. Failure to File a Return.

Whether a person would actually go to jail for not paying their taxes depends upon all the details of their individual tax circumstances. Failing to file a return can land you in jail for one year for each year you didnt file. The IRS imposes a 5-year prison sentence on anyone who files a fraudulent tax return and a 3-to-5-year prison sentence on those who help others do so.

The total penalty for failure to file and pay can eventually add up to 475 225 late filing 25 late payment of the tax owed. In total you could end up paying up to 25 of the overall amount you owe. Well you end up paying a penalty on the amount you owe at 5 per month 45 for not filing and 05 for not paying.

The tax attorneys at The W Tax Group can help you navigate the tax code. Other famous tax evasion cases include gangster Al Capone. If you cannot pay what you owe the state will seize your property.

With this in mind you should also remember that the statute of limitations for tax evasion and failure to file can last as long as six years. In addition to his eight-month prison sentence Sorrentino also received two years of supervised release 500 hours of community service and a 10000 fine. Negligent reporting could cost you up to 20 of the taxes you underestimated.

So with things like this the best move is to err on the side of caution. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. However you can face jail time if you commit tax evasion or fraud.

Beware this can happen to you. If you fail to file your tax returns on time you could be charged with a crime. Most incarcerated people have in-prison jobs that pay a very small amount of and sometimes no money.

However you can face jail time if you commit tax evasion tax fraud or do. If you cannot afford to pay your taxes the IRS will not send you to jail. The following actions can land you in jail for one to five years.

Failing to file a return can land you in jail for one year for each year you didnt file. Not filing a tax return with the IRS is punishable by one year in prison for each year you fail to file. Failure to report specific information could cost up to 520 per return.

Yes he was sent to prison for tax evasion not for bootlegging prostitution or murder. May 4 2022 Tax Compliance. Further it does not start in most cases until you actually file the missing returns.

The state can also require you to pay your back taxes and it will place a lien on your property as a security until you pay. These penalties amount to 5 of a taxpayers delinquent debt each month it remains unsettled. Beside above can you go to jail for not filing taxes for 10 years.

Interest compounded daily is also charged on any unpaid tax from the due date of the return. The IRS will charge you 05 every month you fail to pay up to 25. If you dont want to go to jail for not paying taxes make sure to file your returns promptly and all your tax records and documents do not have any irregularities.

To avoid having to pay exorbitant penalties and interest rates on top of your owed taxes it is best. Incarcerated people like anyone else have to file a tax return if they have enough income. This penalty will stay in place until the entire amount of tax debt has been paid.

Perhaps there was a death in the family or you suffered a serious illness. People may get behind on their taxes unintentionally. If you failed to file your taxes in a timely manner then you could owe up to 5 for each month you didnt file.

As reported by the Department Of Justice in a press release from 2009 through 2016 Daryl Brown received taxable income but did not file tax. Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to 20000. It depends on the situation.

Sometimes people make errors on their tax returns or are negligent in filing. You can go to jail for not filing your taxes. You will not suffer these taxes if you are due for a refund.

Bay Area Tax Attorney Steve Moskowitz explains to KGO 810 what and what not to do when facing a criminal charge regarding your taxes. The United States doesnt just throw people into jail because they cant afford to pay their taxes. According to Moskowitz these cases can get particularly tricky with both civil and criminal aspects.

Ad 4 Simple Steps to Settle Your Debt. In fact you could be jailed up to one year for each year that you fail to file a federal tax return. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

The short answer to the question of whether you can go to jail for not paying taxes is yes. Ad Owe IRS 10K-250K Back Taxes Estimate Tax Debt Online to Check Eligibility. If youre having trouble with the IRS contact.

To avoid late payment penalties you can simply request the IRS for a filing extension. A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve 57 months in jail. However not filing taxes for 10 years or more exposes you to steep penalties and a potential prison term.

If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail. It is true that you can go to jail for not paying your taxes just as you can for filing a fraudulent tax return. Because these amounts are so small prisons often dont issue a.

Though people going to jail for not paying taxes is quite rare it still happens just ask Martha Stewart. Most facilities pay you by putting credit in your commissary account. Ohio tax laws Chapter 574715 of the revised code are comprehensive with legal language and penalties to.

The IRS has three to six years to bring criminal charges against you once your. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years. Penalties can be as high as five years in prison and 250000 in fines.

However if you do not file and pay the failure to file the amount is subtracted from the failure to pay the amount.

Income Taxes Filing Procedures For City State Federal

What Happens If You Don T File Taxes Can You Go To Jail For Not Filing Taxes Parade Entertainment Recipes Health Life Holidays

I M Seeking A Tax Return High Enough To Just Barely Keep Me Out Of Prison Tax Season Humor Someecards Prison Humor

22 Taxing Quotes On The Good Bad And Evil Of Federal Income Tax

Government You Owe Us Money It S Called Taxes Me How Much Do I Owe Gov T You Have To Figure That Out Me Ijust Pay What I Want Gov T Oh No We Know

Can You Go To Jail For Not Paying Taxes

Unfiled Tax Return El Paso Tx Villegas Law Cpa Firm

Who Goes To Prison For Tax Evasion H R Block

Filing Taxes When Incarcerated How To Justice

Civil And Criminal Penalties For Failing To File Tax Returns

The 2022 Tax Deadlines In 2022 Tax Deadline Tax Filing Taxes

What Is The Penalty For Not Filing Taxes Forbes Advisor

10 Common Tax Mistakes That Cost You Money Infographic Tax Mistakes Income Tax Income Tax Return

Can I File My Boyfriend S Taxes If He Is In Jail

Filing Taxes When Incarcerated How To Justice

Understanding Your Own Tax Return Income Tax Return Irs Tax Forms Income Tax

Irs Warns Of Higher Penalties On Tax Returns Filed After September 14 The Irs Warns Taxpayers Who Have Not Yet Variable Life Insurance Tax Attorney Irs Taxes

Preparing Tax Returns For Inmates The Cpa Journal

What To Do If You Did Not File Taxes How To Avoid Major Penalties